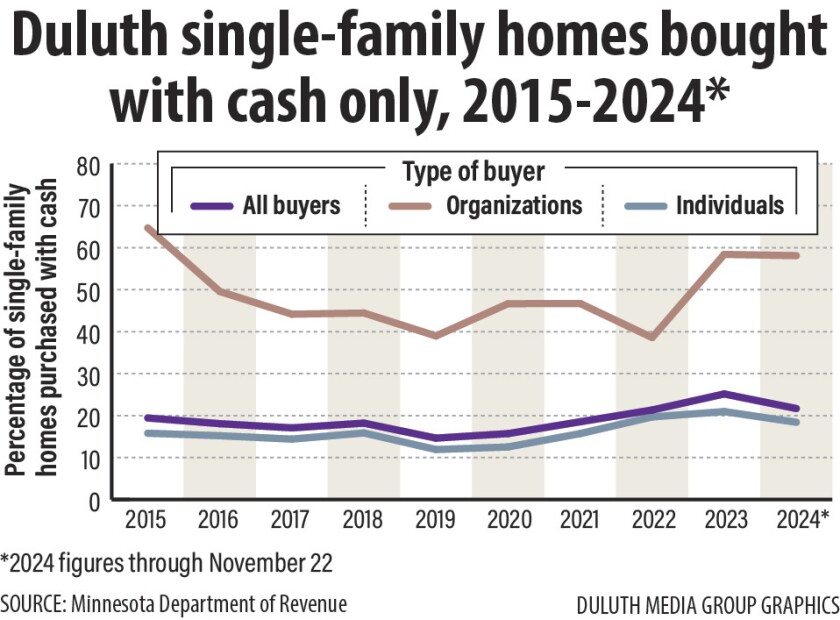

DULUTH — One in four single-family homes sold in Duluth last year was bought with cash only, higher than at any point in the last nine years.

A News Tribune analysis of electronic certificates of real estate value — documents filed with the Minnesota Department of Revenue when property worth more than $3,000 is sold or transferred — dating back through 2015 shows 222 of 882 single-family homes, or 25.17%, sold in the city in 2023 were purchased with cash. A property is considered "single-family" if its use before being sold is listed as such on the certificate.

ADVERTISEMENT

It’s a jump from previous years at 5.7 percentage points higher than 2015 and 10.5 points higher than 2019.

“There are more cash sales than there used to be, that’s for sure,” said Brok Hansmeyer, a Realtor with Re/Max Results in Duluth. “The prevalence of cash sales really took off during the pandemic.”

Hansmeyer, pulling data from the multiple listing service, or MLS, a database used to detail on-market home sales, found a nearly identical rate of cash purchases of single-family homes last year. The MLS, which doesn't capture off-market home sales and likely categorizes "single-family" homes differently, shows that of the 1,028 single-family homes sold in Duluth last year, 254 were bought with cash, or 24.7%, within a half-percentage point of the certificates' rate of cash purchases.

However, the increase in cash-only purchases since the start of the COVID-19 pandemic appears to be slowing. According to certificates filed from Jan. 1 through the first three weeks of November, 21.7% of all single-family homes sold so far in 2024 have been bought with cash, nearly 3.5 points lower than all of 2023.

The increase in cash-only home purchases comes as the median home price increases, mortgage interest rates remain high and the city — like much of the country — faces a housing shortage.

In a competitive housing market, potential buyers often try to make their bids the most attractive and secure for sellers. For example, a buyer might waive an inspection or forgo a traditional mortgage, which will only cover the appraised value of a property minus the down payment.

“It makes things simpler,” Hansmeyer said of buying with cash. “They don’t have to worry about an appraisal coming in, so it’s less risky for a seller.”

ADVERTISEMENT

For organizational buyers, cash is still king

Buyers are listed on the certificates as either organizations or individuals. While organizations are often investors or trusts, they also include nonprofits and government agencies. The person’s name is listed on the certificate if a buyer is an individual.

Last year, 58.4% of single-family homes bought by organizations in Duluth were purchased with cash. That’s down from 2015’s rate of 64.7% but up from 2022’s low of 38.6%.

This year is on pace to be close to last year’s figures, with 58.1% of the single-family homes bought by organizations purchased using cash.

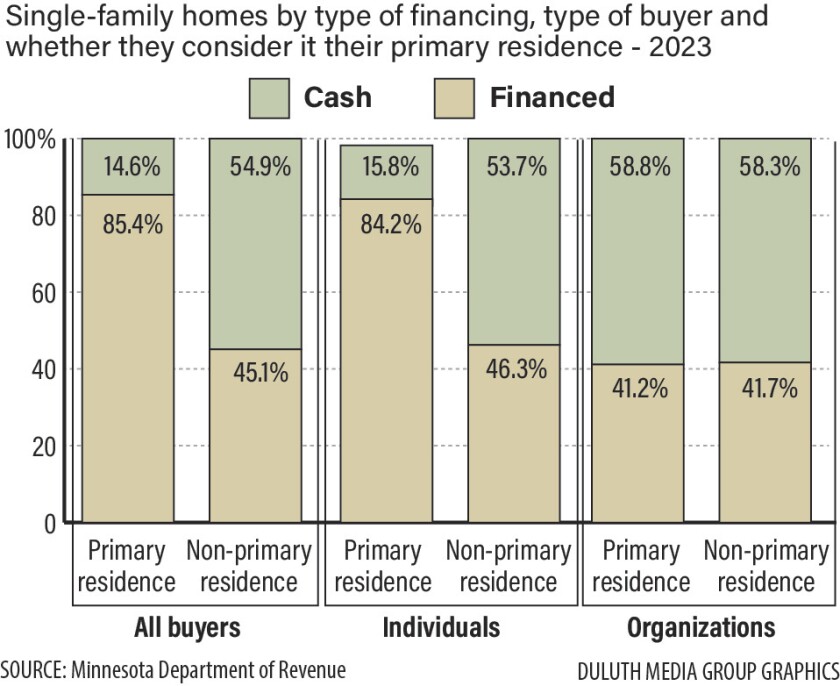

The certificates generally do not specify whether the buyer — either an organization or an individual — is an investor. They do, however, indicate whether the buyer will make the property their primary residence.

Organizations buying a single-family home as a primary residence used cash in 58.8% of those purchases last year. That's nearly the same rate at which organizations last year used cash to buy single-family homes as non-primary residences — 58.3%.

Meanwhile, among individuals buying a single-family home as a primary residence, only 15.8% bought those homes with cash, whereas 53.7% of individuals buying a single-family home as a non-primary residence used cash.

Individuals are increasingly buying with cash

Last year, 20.97% of single-family homes, regardless of whether they would be a primary residence or not, bought by individuals were purchased with cash — up more than 5 percentage points from 2015 and up 9 points from 2019.

ADVERTISEMENT

“Last year and years previous, there was a lot of cash out there,” Brenna Fahlin, a Realtor with Messina and Associates Real Estate in Duluth, told the News Tribune.

So far in 2024, 18.43% of individuals purchasing single-family homes used cash.

Fahlin, who has mainly represented first-time homebuyers for over a decade in the area, said that in addition to seeing many companies making all-cash offers, parents are helping their children buy their first home by buying the house with cash and using a contract for deed or other arrangement to be paid back by the child.

With cash offers, there’s no bank involved, no appraisal to fall through, and less of a chance of the deal crumbling, resulting in the home being back on the market.

“It allows them to compete,” Fahlin said of individuals using cash to buy homes. “It allows them a better opportunity to get their offer accepted, especially in multiple-offer situations.”

Matt Hodge, branch manager of Nations Lending in Hermantown, said individuals are also competing with older adults looking to downsize. Hodge said the house a couple bought for $60,000 decades ago and have since paid off may be worth $400,000 today. They can then sell it and easily afford to buy a $220,000 home in Duluth with cash.

For those without all that cash on hand, Hodge said there has been an increase in the use of loans that don’t meet the standards of Fannie Mae and Freddie Mac. Nonconforming loans, which became rare after the subprime mortgage crisis of the late 2000s, are returning. Hodge said they are expensive but aren’t “predatory."

ADVERTISEMENT

They've become easier to access in the last four years.

“They’ve just removed a lot of the restrictions around them,” Hodge said. “Realizing that as long as you have ethical people doing the program and you have safeguards, then they’re OK.”

For example, Hodge said more bridge loans are being used to allow a buyer to purchase a new house with all cash and then repay it once their previous home sells. Others allow someone to buy a property with cash and then do a cash-out refinance to pull the equity back out two weeks after closing.

“Anything we could do to remove risk so that some type of financed offer would be competitive versus cash,” Hodge said. “That’s kind of where all these new programs sprouted up.”